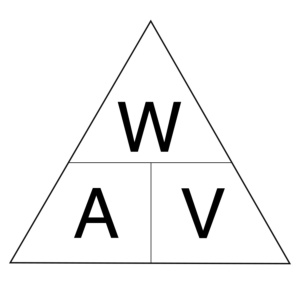

Ebitda Formula

EBITDA Net Profit Interest Taxes Depreciation Amortization EBITDA Operating Income Depreciation Amortization Companies implement these formulas to find out a specific aspect of their business effectively. EBITDA Net profit Interest Tax Depreciation Amortisation What is a good EBITDA ratio.

Ebitda Margin Multiple Formula Example Accounting Basics Accounting Course Financial Ratio

The information in the EBITDA formula is important when calculating your profitability and overall financial performance.

Ebitda formula. EBITDA Net income interest expenses tax depreciation amortization. JC Penney Comisión de Bolsa de Valores. Being a non-GAAP computation one can select which expense they want to add to the net income.

Hay varias métricas disponibles para medir la rentabilidad. The two EBITDA formulas are. Heres how this alternate EBITDA formula looks.

The most common way to calculate your EBITDA margin is by starting with your net income and then adding back in the figures for any interest youre incurring plus taxes depreciation and amortization. EBITDA Net Income Interest Taxes Depreciation Amortization. EBITDA 250000 50000 100000 75000 In this example the firms EBITDA comes out to 500000.

El ebitda ganancias antes de intereses impuestos depreciación y amortización es un indicador del desempeño financiero de una empresa y se utiliza para determinar el potencial de ingresos de una empresa. El EBITDA tuvo 140 millones o 78 millones 141 millones 1 millón 78 millones interés neto. EBITDA Operating Profit Depreciation Amortization.

EBITDA Formulas You can use one of two formulas to calculate EBITDA. EBITDA margin EBITDA Total Revenue By determining a percentage of EBITDA against your companys overall revenue this margin gives an indication of how much cash profit a business makes in a single year. Those anticipating a sale may also need to calculate it on an ad hoc basis for potential buyers.

EBITDA profitul net cheltuiala cu dobanda cheltuiala cu impozitele cheltuiala cu amortizarea si deprecierea Indicatorul arata cati bani genereaza o companie din activitatea sa curenta inainte de a-si plati datoriile taxele si de reflecta cheltuielile non-cash amortizarea. EBI Earnings Before Interest Expense T Taxes D Depreciation A Amortization Starbucks Example Let us see the EBITDA Margin calculation of Starbucks. Con el ebitda factores como el financiamiento de la deuda así como la depreciación y los.

The basic EBITDA formula is. How to calculate EBITDA. Or EBITDA EBIT Depreciation Amortization Whichever formula you use you should have all the information you need to calculate EBITDA on your profit and loss statement.

EBITDA Operating profit depreciation amortization In the above report operating profit is not given directly so we will calculate that by the given information. Its easy to convert the monetary value of this metric into a ratio which is called the EBITDA margin and doing so makes it easier to compare businesses of different sizes. In ce context se utilizeaza.

Alternate EBITDA Formula Another way to calculate EBITDA is to add back the non-cash expenses of depreciation and amortization to a companys earnings before interest and taxes EBIT. Dado que el impuesto sobre la renta era originalmente un crédito de 1 millón lo dedujimos para calcular el EBITDA. However EBITDA is the more common metric to measure a companys financial performance.

EBITDA Net Income Interest Taxes Depreciation Amortization. EBITDA Operating Income EBIT Depreciation Amortization To Calculate EBITDA Ratio you can use the below formula EBITDA Margin EBITDANet Sales When we drill down. But earnings before interest taxes depreciation and amortization aka EBITDA hit a snag regarding the specific taxes you should include.

EBITDA Net income Taxes Depreciation Amortization Interest 18 million. If youre starting your EBITDA calculation with your net income instead of revenue you would use this formula. The two formulas end up at the same number.

Interest depreciation and amortization expenses are operating expenses. Multi-step income statements may vary slightly but the EBITDA formulas components should be easy to find. The formula for an EBITDA margin is as follows.

EBITDA Net Income Taxes Interest Expense Depreciation Amortization Unlike the first formula which uses operating income the second formula starts with net income and adds back taxes and.

Ev Ebitda Ratio Ev Ebitda Formula Find Best Stock For Long Term Holding By Ev Ebitda Calculation In 2021 Fundamental Analysis Stock Market Basics Enterprise Value

How To Determine Net Income In Accounting Accounting Accounting Basics Bookkeeping Business

Ebitda Formula Accounting Education Finance Binder Free Finance Printables Free

Current Ratio Formula Meaning Example Interpretation Financial Ratio How To Do Yoga Financial Management

Ebit Vs Ebitda Differences Example And More In 2021 Accounting Education Financial Analysis Accounting And Finance

Definition Of Ebitda Cash Flow Statement Financial Analysis Financial Analyst

What Is Ebitda Margin Definition Formula With Example In 2020 Marketing Trends Financial Analyst Financial Literacy

Ebitda Formula Definition Examples Fundera Small Business Insurance Business Tax

What Is The Formula For Calculating Ebitda

Ebit Meaning Importance And Calculation Bookkeeping Business Finance Investing Small Business Bookkeeping

Enterprise Value Formula Equity And Enterprise Value Bridge Financial Edge Training Enterprise Value Enterprise Financial

Definition And Explanation Format Of Note Payable Classifications Of Notes Payable Example 1 Journal Ent Journal Entries Promissory Note Computer Maintenance

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf Fcff In 2021 Cash Flow Statement Cash Flow Financial Analysis

Chart Title Cannot Be Made Dynamic Chart Learning Microsoft Microsoft Excel

Cash Flow Management Bookkeeping Business Economics Lessons Accounting Education

Ebitda Calculation Insurance Agency Accounting Basics Insurance Agency Business Analysis

Property Plant And Equipment Schedule Template Excel Schedule Template Finance Career Financial Analysis

Pin On Liquidity Ratio Analysis

Fcff Formula Examples Of Fcff With Excel Template Cash Flow Statement Excel Templates Formula

Post a Comment for "Ebitda Formula"